The 1099-B will provide taxpayers with information regarding their cost basis and proceeds from the sale of capital assets. TaxBit automatically tracks taxpayer’s holding periods and helps taxpayers claim long-term tax advantaged rates when eligible.īrokers of capital assets such as exchanges are required to provide taxpayers who exchange on their platforms with a 1099-B at the end of the year. If you have unrealized losses, then holding period is less important and it is typically most beneficial to claim the losses to reduce your tax liability (check out this blog learn more about crypto losses tax). Long-term gains are taxed at favorable rates, so it is beneficial to hold assets with unrealized gains for one year or longer. If you hold a particular cryptocurrency for longer than one year then you are eligible for long-term tax advantage rates. Short-term gains are taxed at the same rates as ordinary income. Assets held for less than one year will be reported in the short-term section. The IRS 8949 tax form is divided into two sections.

#Coinbase pro form 8949 full

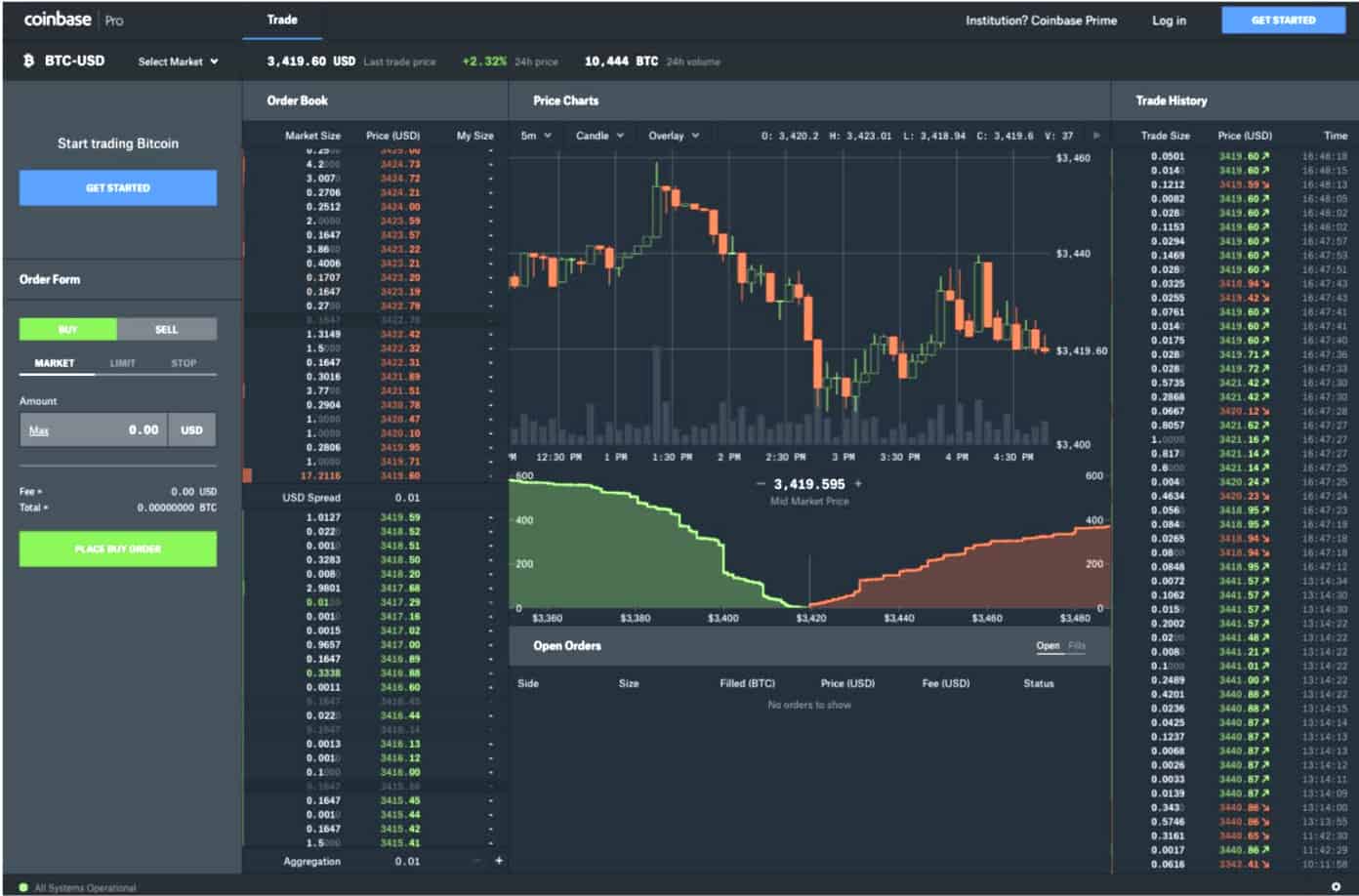

TaxBit connects to exchanges via “read only” API’s and provides a full audit trail of all cost basis information. TaxBit tracks every movement of cryptocurrency and all cost basis information. Every cost basis pool must be accounted for in reporting cryptocurrency taxes. In the above example, you can see that the user acquired 39.89 Litecoin on three different days and then traded all of their Litecoin for. This transaction would be reported on IRS 8949 as follows: (Proceeds - Cost Basis = Capital Gain/Loss).įor example, if you purchased 4 Litecoin for $258.30 and later sold the 4 Litecoin for $977.55 then you will realize a gain of $719.25. To determine the gains and losses to report, taxpayers must subtract their cost basis from their proceeds. Similar to equities, every purchase of cryptocurrency sets a cost basis in the asset, and every trade or sale results in taxable proceeds. In reporting cryptocurrency transactions on the IRS 8949 taxpayers should: 1) properly report their capital gains and losses 2) classify transactions as short or long-term and 3) report whether the transactions were reported on a 1099-B. Taxpayers are required to report their capital gains and losses on the same form (IRS Form 8949) as stocks and equities. In 2019, the IRS released further guidance through Revenue Ruling 2019-24, which brought cryptocurrency in even further alignment with equities and other capital assets for tax purposes. In 2014, the IRS declared that cryptocurrency, such as Bitcoin, is treated as property for tax purposes.

0 kommentar(er)

0 kommentar(er)